I'm a property expert that still remembers the days when having broadband was a selling point! My articles cover issues that homesellers face in the UK and answer the questions we're all asking. I've bought and sold properties and helped others do the same, so my writing comes from years of experience.

Read Full Bio >As Per Reports – A Third of Sold UK Properties are Sold £25K Below their House Price Estimate

The most considered decision of any property purchase is the offer. The difference between what vendors consider to be their house price estimate and a buyer’s valuation of the property can be worlds apart.

Getting a house price estimate right can be challenging – and have serious ramifications that will affect the success of the purchase. Offer too little and buyers may be instantly rejected. Offer too much and, at best vendor’s suspicions may be raised. At worst, buyers can end up paying an inflated property price.

However, new research by Zoopla has clarified what is an acceptable nationwide house price estimate to help buyers decide how to make an offer that reflects the true market value of the property they wish to purchase.

With more than 8 years’ experience, Springbok Properties know how to sell homes fast across the UK. We have helped more than 5,500 homeowners achieve 99% market value from the sale of their home. To list your home, or speak to a member of our award-winning customer service team, call us TODAY on: 0800 068 4935.

Zoopla’s House Price Estimate Findings

New findings from leading online property portal Zoopla have found that the average nationwide house price estimate sold price is £25,000 less than the asking price.

Zoopla found that buyers across the UK will almost certainly ask vendors for a reduction. This, however, is entirely dependent on individual circumstances. There are instances when buyers have been happy to pay the full asking price for a home that they are determined to purchase.

According to Zoopla, vendors can expect offers £24,989 below the listing house price estimate.In addition, just under a third of properties currently for sale are listed at a reduced price to attract serious buyers.

Springbok Properties gives away over 1900 FREE home valuations every month. These no-obligation valuations include an accurate house price estimate, FREE consultation, expert advice on all your selling options and comparable prices of local properties that are currently on the market or recently sold. To find out how you can get an accurate house price estimate, call us TODAY on: 0800 068 4935.

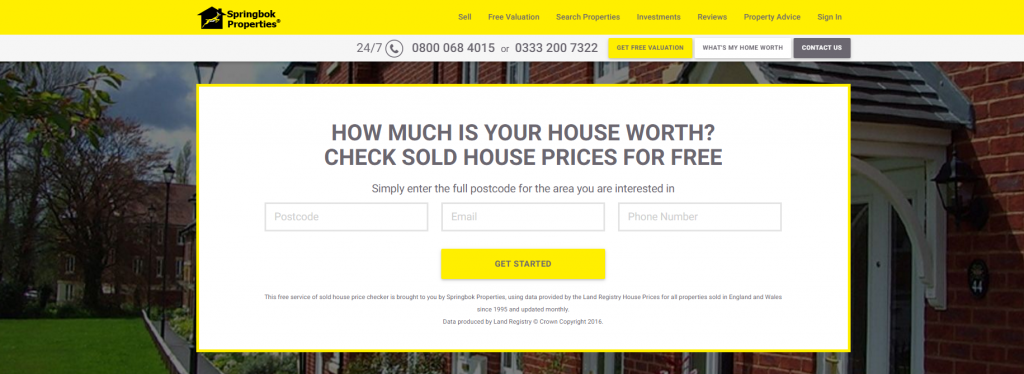

Check how much is your house worth on Springbok’s Free Sold House Price Estimate Tool

The North of England and House Price Estimate Sales

Where you live in the UK influences the percentage reduction on any sold house price estimate. This should come as no surprise, given that some areas of the UK are more desirable than others.

Homeowners in north east of England are particularly susceptible to reduced house price estimate sales. Zoopla found that Darlington, County Durham experienced the greatest percentage homes sold after a reduction, at 46%. Elsewhere in the region, house price estimate sales reductions were also high in South Shields, Tyne and Wear.

Across the UK, Middlesbrough in North Yorkshire, Woking in Surrey and Great Yarmouth in Norfolk were highlighted as areas with the greatest house price estimate sales reductions.

However, these areas each demonstrate superior value for money. First-time buyers have a greater opportunity of getting onto the property ladder and households with lower incomes can buy a home that’s more likely to meet their needs than other regions in the UK.

Springbok Properties been voted the best UK property company, 2 years in a row. Our dedication to our customers is highlighted by our 24/7 service. Get in touch with us TODAY on: 0800 068 4935 and find out how we can sell your home in a matter of days.

The South of England and House Price Estimate Sales

In contrast to the north of England, the south enjoys a lesser reduced rate of house price estimate sales. Vendors in Exeter and Devon are the least likely to have their asking prices reduced to secure a sale, with just 22% of properties needing a house price estimate reduction.

Given the inflated prices of homes in London, the property market should be considered as separate from that of the south east of the UK. Any house price estimate sales reductions will not reflect reductions across the rest of the region.

The borough of Merton, within London has the greatest proportion of reduced house price estimate listings at 39.1%. Homes in the boroughs of Kensington and Chelsea typically see reductions of 7.7% on all sold properties – a percentage that equates an average of £135, 702 reduction. Westminster has similar sold house price estimate reductions of 7.3%, or a reduction £124,144.

As a nationwide online property business, Springbok Properties can sell homes anywhere in the UK fast, and completely hassle-free. We take a proactive approach to property and have a nationwide portfolio of property investors. This means that we give you the best possible chance of selling your home for a house price estimate that reflects the value of your home. To list your property, call us TODAY on: 0800 068 4935.