I'm a property expert that still remembers the days when having broadband was a selling point! My articles cover issues that homesellers face in the UK and answer the questions we're all asking. I've bought and sold properties and helped others do the same, so my writing comes from years of experience.

Read Full Bio >Given Current UK House Prices There’s Never Been a Better Time to Sell Your Property

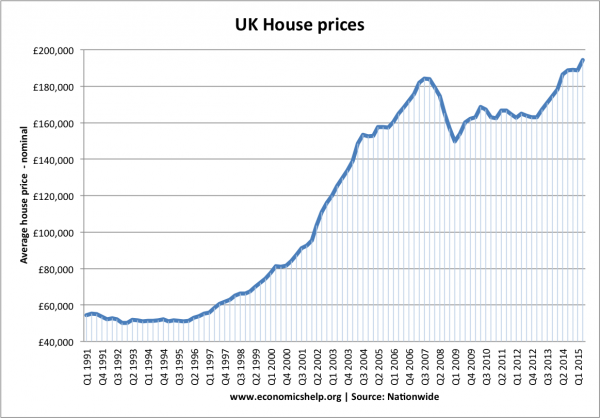

Did you know that house prices in the UK rose by 1.7% in December 2016? This means that in one month alone, the average UK house price rose by nearly £4,000!

Halifax plc, one of the UKs prominent mortgage lenders, has said that the final quarter of 2016 saw a 2.5% increase in house prices, when compared to the previous quarter. Across the UK, millions of homeowners have benefitted from this, with Luton, a mere one-hour commute from central London, recording the biggest leap as house prices jumped by 19.4%. Elsewhere, the London borough of Barking and Dagenham saw a 17.9% rise.

This means that there’s never been a better time to sell your house anywhere in the UK, and Springbok Properties has the knowledge and experience to sell your house quick for up to 99% of its true market value.

Call Springbok Properties today on 0800 068 4015 for a chat with one of our experienced customer service team, and we’d be happy to advise you on the current state of the UK property market, and discuss your options.

Straightforward, Upfront Guidance on UK House Prices

Forecasting the UK property market can be strikingly challenging at the best of times. Leading housing experts are currently very tentative to discuss the future of UK house prices in 2017 and beyond.

In a post-Brexit world, with negotiations ongoing and a hesitancy to discuss the nationwide economic implications of the split with the European Union, the effect this may have on the UK economy and house prices can only be estimated.

However, many leading property experts believe the political and economic unrest may affect house prices in 2017 and the future. Martin Ellis, a leading housing economist with Halifax plc is convinced that yearly growth of house prices will slow to between one and four percent by the end of 2017. This slowdown in inflated house prices UK will attract an increased number of buyers.

Springbok Properties provide our customers with straightforward and upfront guidance on all UK house prices. Our experienced customer service team understand the UK marketplace, and can provide you with an accurate and FREE valuation and listing price.

Mortgage Lending is Stable

With the Bank of England’s announcement that, in November 2016, home buying figures had remained stable, the property market has been unaffected by the present economic and pollical climate. Mortgage lending is stable across the whole of the UK.

The Bank of England found that UK financial institutions approved more than 67,000 mortgages, with a very similar amount being approved the previous month. Buyers are still in the market for homes, and can finance the purchase of a property, regardless of house prices and budget and location.

Springbok Properties can provide you with thorough help when getting a mortgage. Our recommended team of FSA financial advisors will guide you through the whole process, helping you achieve the right mortgage. We can also help you reduce your monthly mortgage payments.

Contact us today on 0800 068 7935 or follow the link to fill out a contact form for a FREE, no obligation consultation today!

How Locations Across the UK are Performing

In January 2017, The Daily Telegraph published an article on the most sought-after suburbs across Britain. By looking at property across the UK and the growth of regional house prices, The Telegraph compiled a table of the ‘most sought-after suburbs across Britain’, excluding London.

The article details that Cambourne and Harwick in Cambridge enjoyed the greatest annual price growth at 18.6%, with Altrincham and Hale in south Manchester coming in a close second with an annual price growth of 17.3% in 2016.

Suburbs with superior amenities, access to leisure and cultural pursuits, without the disadvantage of unaffordable housing, typically have more attractivehouse prices, and attract buyers that want to live there. Suburbs close to large city centres like Manchester and Birmingham are also highly desirable, attracting higher house prices.

With a wealth of experience monitoring house prices UK, Springbok Properties knows how to ensure your home is listed for the right asking price, enticing buyers and selling your home sold fast. To find out how your location is performing, contact us today on 0800 068 7935.

Springbok Properties are experts in providing complete turn-key solutions for vendors looking to sell their home. We have comprehensive knowledge of up-to-date house prices across the UK, and will advise you on the best approach to sell your home fast for its true market value.